OneWater Marine (ONEW)·Q1 2026 Earnings Summary

OneWater Marine Beats Q1 as Pre-Owned Sales Surge 24%, Stock Jumps 4.5% After Hours

January 29, 2026 · by Fintool AI Agent

OneWater Marine (NASDAQ: ONEW) delivered a solid start to fiscal 2026, with pre-owned boat sales surging 24% and gross margins expanding to their highest level in over a year. The marine retailer reported Q1 FY2026 revenue of $381 million, up 1% year-over-year, with adjusted EBITDA doubling to $4 million. The stock jumped 4.5% after hours to $13.82 following the release.

Did OneWater Beat Earnings?

Yes. OneWater delivered better-than-expected results across all key metrics:

The dramatic improvement in adjusted EPS—from a loss of $0.54 to just $0.04—reflects execution on margin initiatives and the benefit of exiting underperforming brands in FY2025.

What's Driving the Revenue Mix Shift?

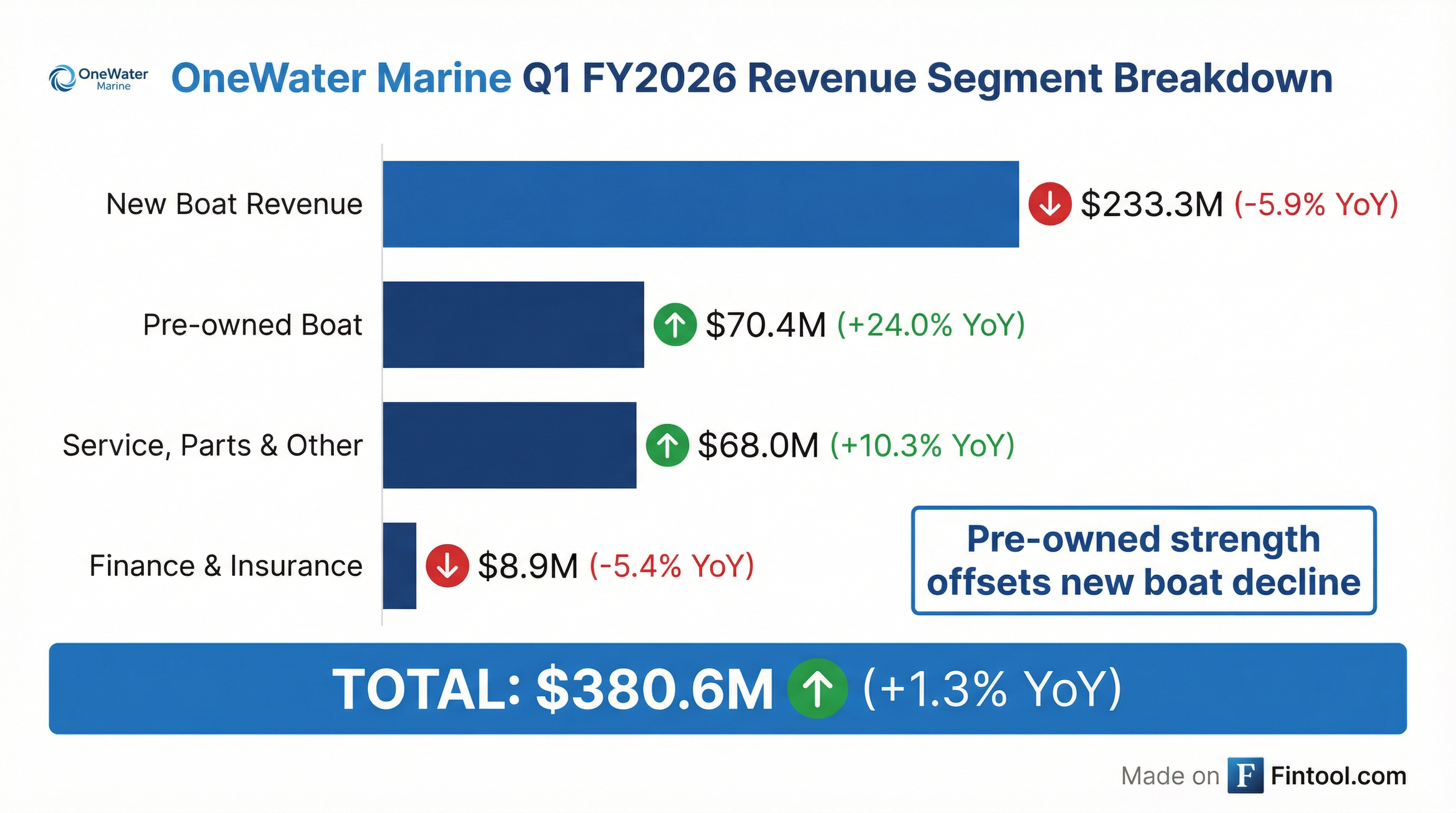

The headline 1.3% revenue growth masks a significant transformation in OneWater's business mix:

Key segment dynamics:

- New Boat Sales (-5.9%): Declined to $233.3M due to lower unit volumes, but management prioritized margin discipline over volume, and average selling prices increased

- Pre-Owned Boats (+24.0%): Surged to $70.4M on both higher units sold AND higher average prices—a reflection of increased trade-in activity as customers upgrade

- Service, Parts & Other (+10.3%): Rose to $68.0M with growth in both Dealership and Distribution segments

- Finance & Insurance (-5.4%): Declined slightly as a percentage of boat sales to $8.9M

This mix shift is strategic. Pre-owned boats typically carry higher margins, and the service/parts business provides recurring revenue regardless of new boat cycles.

How Did the Stock React?

OneWater shares closed at $13.22 on the session before earnings (down 2.5% intraday), but jumped to $13.82 in after-hours trading—a 4.5% pop on the results.

Stock context:

- 52-week range: $10.14 - $21.00

- Market cap: ~$219M

- Current price vs. 50-day MA: Trading at 10% premium to the $11.98 average

- Current price vs. 200-day MA: 8% discount to the $14.33 average

The stock has recovered significantly from its 52-week low of $10.14 (reached in late 2025 during industry-wide pessimism), but remains well below its 52-week high of $21.

What Did Management Guide?

Guidance maintained. OneWater reiterated its FY2026 outlook:

Management expects the industry to be "flat to down low single digits" for the year. When factoring in lost revenue from exited brands, the company expects dealership same-store sales to be flat year-over-year.

Leverage trajectory: CFO Jack Ezell expects net debt leverage to decline to ~4x by March 2026 (post-Distribution divestiture) and under 4x by fiscal year-end.

Executive Chairman Austin Singleton stated: "We delivered a solid first quarter in line with expectations, demonstrating the resilience of our business model and continued progress against our strategic priorities."

What Changed From Last Quarter?

Comparing Q1 FY2026 to Q4 FY2025:

The sequential decline is entirely seasonal—Q1 (Oct-Dec) is historically OneWater's weakest quarter as it falls between the summer boating season and the winter boat show season. The key positive: gross margin improved sequentially even in the off-season.

Balance sheet highlights (as of December 31, 2025):

- Cash: $32.2M

- Total Liquidity: $49.2M (including credit facility availability)

- Total Inventory: $601.5M (down from $636.7M YoY)

- Total Long-Term Debt: $399.4M

- Net Debt / TTM Adj. EBITDA: 5.1x

What's the Strategic Update?

Distribution segment divestiture in progress: OneWater classified certain Distribution segment assets as "held for sale" during the quarter. The company expects to close this divestiture before March 31, 2026, with net proceeds applied toward debt reduction.

Austin Singleton framed the decision: "This action is not a reflection of underlying operational performance, but rather an opportunistic step to sharpen our focus and strengthen the balance sheet."

Inventory management remains a competitive advantage: Austin Singleton emphasized on the call: "[Inventory] is in the best shape that it's been since I can remember being in this business." This positions OneWater well for the spring selling season, with a clean mix of premium brands and new models.

Q&A Highlights

On boat show performance (Austin Singleton):

"It's been what we thought: flat. Maybe even slightly down, but the enthusiasm is there, the consumer still is there. One of the things that shocked us a little bit—the margin's better than we expected. A little bit of that comes into model mix... people at the boat shows are typically buying the new hot unit where you don't have as much competition."

On inventory freshness (Austin Singleton):

"[Inventory] is in the best shape that it's been since I can remember being in this business. It was painful to get there, but we're there... most of the premium brands' inventory is cleaner than it's been, and dealers haven't been ordering a lot. Manufacturers haven't been producing. Everybody seems to be off 35%-45%."

On pricing dynamics (Austin Singleton):

"We're by no means saying customers are coming in and we're giving them on the price and they're writing us a check. It's still a buyer's market, but instead of working this to like there's no meat left on the bone, it's kind of like here's our best offer... everybody has their floor. A lot of that's just because now everybody's not in a panic mode of having too much inventory."

On pre-owned availability (Austin Singleton):

"The real difference today vs. COVID was the consumer doesn't have to wait 9-12-16 months to get their new boat. So they don't have that huge amount of time to tell 50 people they're getting a new boat and somebody go 'what are you doing with your old one?' We're just getting more trade-ins because people are able to get their new boat quicker."

On margin outlook (Austin Singleton):

"We feel we gave away at least 1% last year just exiting those brands, and that's done. So you would think somewhere around that 1% is just like an absolute laydown... what we're seeing today is it's a little bit better than that just because of the way the consumer is acting."

On industry data: Q1 SSI data for segments OneWater operates in was down high-single to low-double digits. However, management cautioned this is a "weird quarter" due to December holidays and not indicative of full-year trends.

No adverse impact from the government shutdown or recent winter storms (company has minimal presence in affected regions).

Key Risks to Monitor

- Leverage: Net debt leverage of 5.1x is elevated; execution on the Distribution divestiture is critical to reaching <4x by year-end

- New boat softness: New boat revenue declined 5.9% despite flat same-store sales—volume is still pressured

- Industry cyclicality: Q1 SSI data was negative high-single to low-double digits; any macro deterioration could pressure results

- OEM promotional support: As inventories clean up, manufacturer promotional dollars will decline, creating margin variability

Forward Catalysts

- Winter boat show season (January-March): Early shows have been "flat, maybe slightly down, but enthusiasm is there" with better-than-expected margins

- Distribution divestiture expected to close by March 31, 2026, bringing leverage to ~4x

- Q2 FY2026 earnings (typically released in late April/early May)—peak selling season results

- Long-term industry recovery: Industry at ~145K new units vs. long-term average of ~180K—significant pent-up demand when conditions normalize

Report generated by Fintool AI Agent. Data sourced from company filings and S&P Global.

Related Links: